Six weeks ago, the idea of 97 galleries from 20 countries descending upon Los Angeles for an art fair seemed imaginable. On January 7, a series of devastating wildfires engulfed entire neighborhoods, with countless collectors and artists losing homes and their life’s work as the city burned. But yesterday’s VIP opening proved that Frieze Los Angeles perseveres: there were sold-out booths and steady sales for numerous mid-sized dealers, amidst a market still in correction mode.

“It feels a little bit like a fair with hand breaks on,” says art economist and Yale Professor Magnus Resch, author of How to Collect Art, published by Phaidon last year. “I sense less excitement around the fairs and everything is a little bit muted—yes, because of the fire issue. But also the market fatigue already existed in Miami this year.” However, Frieze LA caters to newer collectors with lower price points than Art Basel Miami Beach. “While the world’s top collectors come to Miami in high quantity, we have less of those coming to LA, simply because they are already served by the Miami version. Frieze LA is really a fair for collectors in the area that I call HENRY’s, ‘high earners, not rich yet,’ and lots of first-time buyers.”

“People want to support LA right now after the fires. More galleries have brought LA artists to the fair than usual,” says New York-based Tanya Traykovski, founder of TT Fine Art, who acquires works on behalf of corporations and prominent private collectors in the areas of entertainment, finance, and real estate. “There were concerns about taking up hotel rooms, but I checked in with some clients and friends in LA, who said most of the people who have been displaced are thankfully in Airbnbs and longer-term solutions, so that was an incentive for both me and my clients to come.”

Blockbuster, seven-figure sales always make international headlines, and yesterday was no exception. David Zwirner reported the sale of a 1997 Elizabeth Peyton painting for $2.8 million, an Alice Neel for $1.8 million, a Lisa Yuskavage for $1.6 million, and a 2015 Noah Davis artwork for $2.5 million. In the same range, Gladstone Gallery sold a Keith Haring painting for $2 million. Of course, most buyers aren’t picking up million-dollar works at art fairs, and even in the six figures, interest in various painting trends certainly waxes and wanes—hybrid Abstraction-Figuration and Hyper-Realism continue to perform strongly in early 2025.

What emerging trends are influencing buyers at the moment? “I’m seeing a lot of Nabis influence that I think is a newer trend,” says Traykovski. “It looks really fresh amongst younger artists—in the vein of Nathanaëlle Herbelin, who just had a show in the Musée d'Orsay.” As for the political landscape, Traykovski adds, “I think Trump’s anti-DEI efforts are going to face a lot of pushback in the art world. Buyers who are not supportive of Trump and Musk’s agenda are going to look seriously at artists who are sidelined in the present moment.”

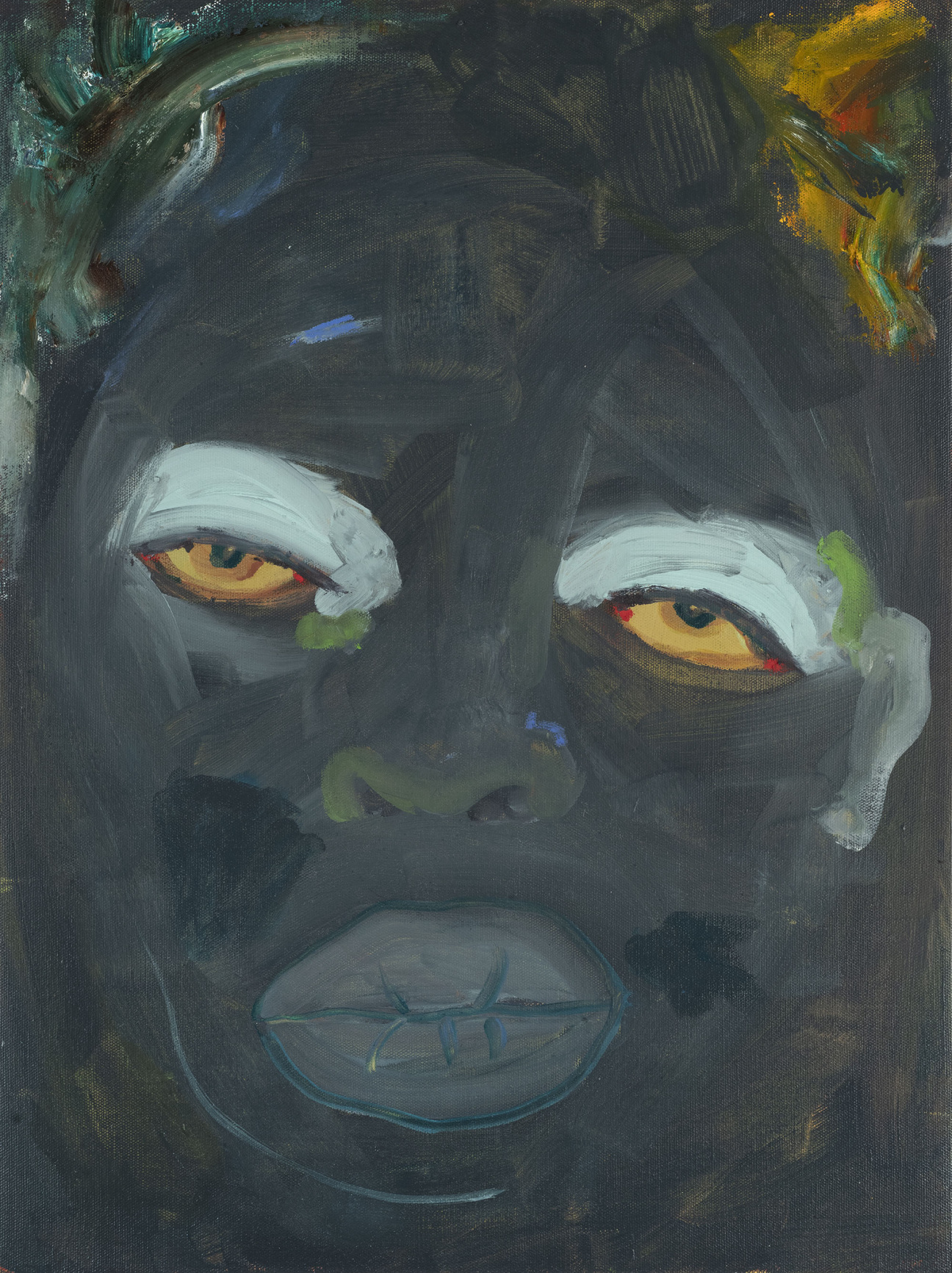

Institutional cache is a critical factor for gallery selections when it comes to solo booths at Frieze, as museum interest broadens collector interest by propelling painters to a new tier. “February James’s inclusion in last year’s ‘Singular Views: 25 Artists’ at the Rubell Museum, along with ‘Recent Acquisitions’ in Miami, has brought even more eyes to her work,” says Storm Ascher, founder of Superposition Gallery, a nomadic outfit that pops up in borrowed space across Los Angeles, New York, and Miami. James’s haunting abstract portrait Opposing Beliefs That Come True, 2025, sold at Frieze LA for $15,000. Ascher adds: “The Rubell Collection has a long history of championing groundbreaking artists at pivotal moments in their career. This platform has helped place February's work in broader conversations.”

Of course, galleries routinely send clients previews a week or two ahead of a major fair—and some of yesterday's reported figures may have actually occurred before the fair opened its doors. But whether a collector discovered the work in a booth or online, the numbers reflect the market as it stands today and may help to guide wary buyers. “Most people who go to art fairs are not experts,” says Resch, who believes that a pervasive lack of pricing transparency hurts the art market—particularly in sluggish times. “The lack of prices is the key reason people don’t buy art,” he explains. Furthermore, he emphasizes that the art market is not correlated to the financial one. “[The art market] often lags behind and is heavily dependent on a small number of individuals. If a few of them drop out, everybody feels it.”

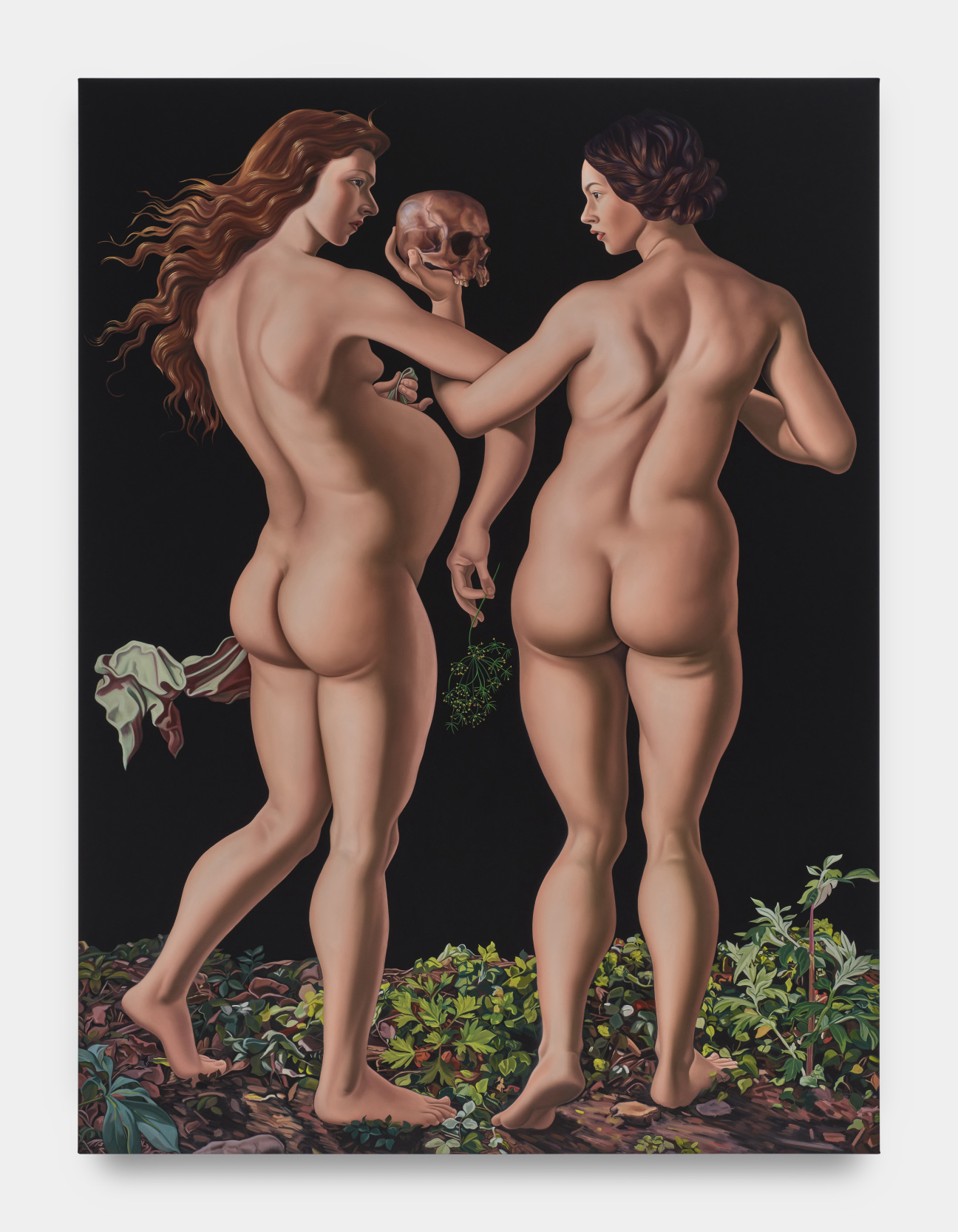

Yesterday, LA’s Night Gallery sold two Jesse Mockrins (the artist is known for her 21st-century twist on Baroque paintings), which will travel from the Santa Monica airport hangar to the artist’s upcoming solo exhibition at the Art Gallery of Ontario in Toronto this fall. Night Gallery reported that each went for somewhere between $100,000 and $120,000. Meanwhile, international heavyweight Hauser & Wirth sold out its first solo presentation of Ambera Wellmann—particularly one to watch—with opening day sales of $150,000; $200,000; and $210,000.

For Frieze VIPs looking to discover new talent, Almine Rech sold a fantastical, acrylic and mixed media 3-by-4.5-foot canvas, from Japanese-American artist Tomokazu Matsuyama for $550,000. Timothy Taylor reported strong sales: an Annie Morris sculpture for €155,000, as well as a Sean Landers for $45,000, a Hayal Pozanti for $75,000, and two Paul Anthony Smith paintings, fetching $35,000 each.

Tina Kim’s highlights include a Ghada Amer bronze sculpture for $90,000 and a Ha Chong-Hyun painting at $390,000. During the VIP program, Ortuzar sold seven sculptures by the 87-year-old Japanese-Brazilian artist Megumi Yuasa, the first presentation of his work in the United States; the ethereal, ceramic Espassaro, c 1990s, for example, sold for $45,000.

Rounding out the VIP preview, Karma placed a number of contemporary painters, including a Reggie Burrows Hodges for $325,000, a Henni Alftan for $85,000, and a Calvin Marcus for $135,000, in addition to a still life by Persian-American abstract-expressionist Manoucher Yektai for $300,000 and a still life by Chicago-born surrealist Gertrude Abercrombie for $225,000.

in your life?

in your life?