It’s no secret that issues of equity and access plague the art market on both ends of the spectrum. Artists typically receive payment only after a work’s initial purchase and are left out of any resale residuals as their work appreciates in value. Meanwhile, the question of public access to culturally and historically significant works sequestered in private collections looms ever-larger.

But this past year saw the early rumblings of an imminent third-party intervention in these dynamics. By harnessing the power of blockchain technologies, a number of intrepid organizations have launched attempts to reduce the opacity of the secondhand art market. Of course, there’s Fairchain—the wunderkind company that counts influential art world figures like artists Ludovic Nkoth and Hank Willis Thomas as well as gallerist Hannah Traore among its advisors—which saw an increase in support last year among artists and gallerists worldwide.

More intriguing still is the increased prevalence of DAOs in the art world. DAOs—decentralized autonomous organizations—essentially structuralize the otherwise informal ties of diffuse collectives, enabling members to pool resources and direct them toward shared aims—at the auction house, for example. As crypto artist Rhea Myers put it in a recent Frieze roundtable discussion, “DAOs are a collaboration between code, capital, and community: they are the blockchain equivalent of a charitable trust.” Many art world and Internet radicals are quick to point out that DAOs are nothing new—but in the wake of the pandemic and the volatile rise of cryptocurrencies, they have no doubt earned broader recognition as experimental entities that have the power to shape new models for wealth distribution among artists, institutions, collectors, and communities.

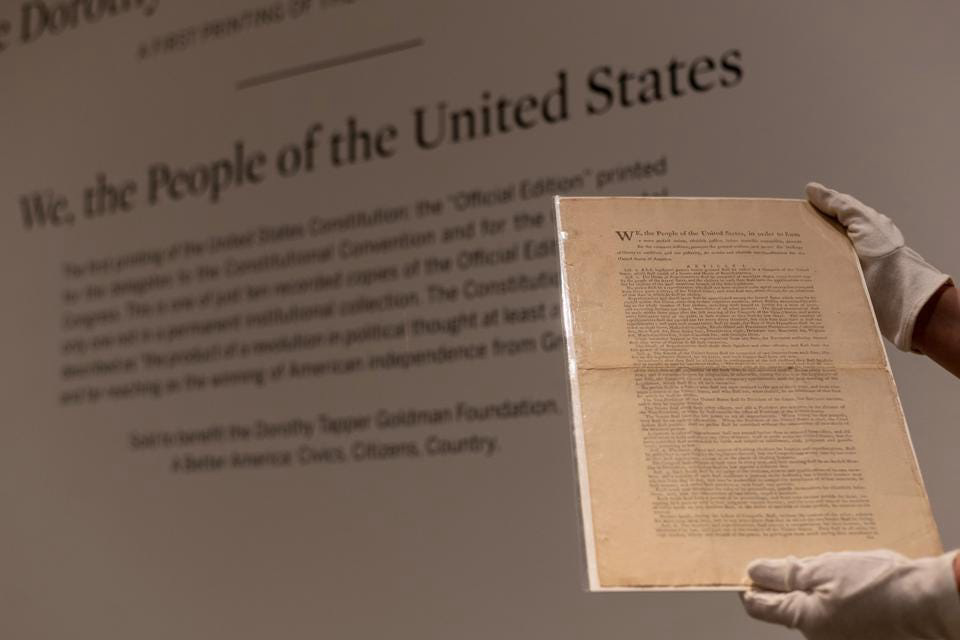

In 2022, one DAO (known as ConstitutionDAO) cemented the momentous advent of such entities when it entered a bidding war over a first-edition copy of the U.S. Constitution at a Sotheby's auction last November. For Brooke Lampley, co-head of the fine art division and the chairman and worldwide head of sales for Global Fine Art at Sotheby’s, the DAO’s presence marked a seismic shift in her industry. As she told CULTURED, “I was really taken by the populist idea of community ownership. It was a new hurdle for us to have a DAO buyer…We wanted to create that access and make it possible for the DAO to participate.” While ConstitutionDAO ultimately lost out to a private buyer that acquired the historical document for a whopping $43 million with fees, the presence of collective action in the halls of an established auction house brought the notion of community access to cultural artifacts into direct confrontation with the interests of would-be buyers largely focused on private ownership.

More and more, institutions are turning their attention to DAOs. Early this year, The New Museum’s cultural incubator NEW INC plans to launch Unnamed Fund, a DAO focused on “sustaining those underserved by traditional funding through the equitable distribution of capital.” Through the establishment of a community-led fund, the DAO will attempt to highlight and fund community projects, as well as acquire works that reflect its mission.

While the potential impacts of the DAO’s entrée into the established art market remain murky, it’s clear that such entities have an audience—one eager to see a more diffuse and collaboratively oriented paradigm take hold.